Media stories have run rampant about another housing market crash. With affordability challenges and recurring recession discussions in all markets around the country, it's understandable why worries have surfaced. However, a closer look at the data reveals that today's housing market is significantly different from the conditions that preceded the 2008 housing crash. I have discussed this in other articles, but now more than ever, we need to revisit the differences…

Tighter Loan Standards

Obtaining a home loan is much more difficult now compared to the period leading up to the 2008 housing crisis. Lending institutions have implemented stricter standards, making it harder for individuals to qualify for mortgages or refinance existing ones. This contrasts sharply with the looser lending practices of the past, which exposed banks to substantial risk. The graph below, from the Mortgage Bankers Association (MBA), illustrates this disparity. A lower number indicates a more challenging mortgage environment, while a higher number suggests easier access to loans.

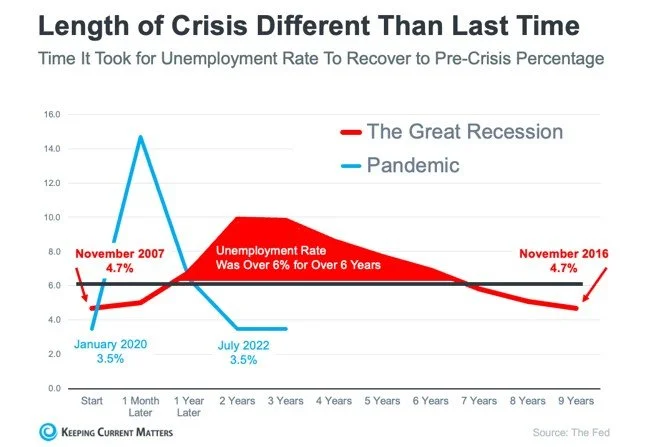

Faster Unemployment Recovery

Although the pandemic caused a spike in unemployment in recent years, the jobless rate has already rebounded to pre-pandemic levels (blue line in the graph below). This contrasts with the Great Recession when a significant number of people remained unemployed for an extended period (red line in the graph below -Source St. Louis Federal Reserve and Keeping Current Matters).

The swift job recovery this time has positive implications for the housing market. With a larger proportion of the population employed, the risk of homeowners experiencing financial hardship and defaulting on their loans is reduced. This strengthens the current housing market and mitigates the likelihood of widespread foreclosures.

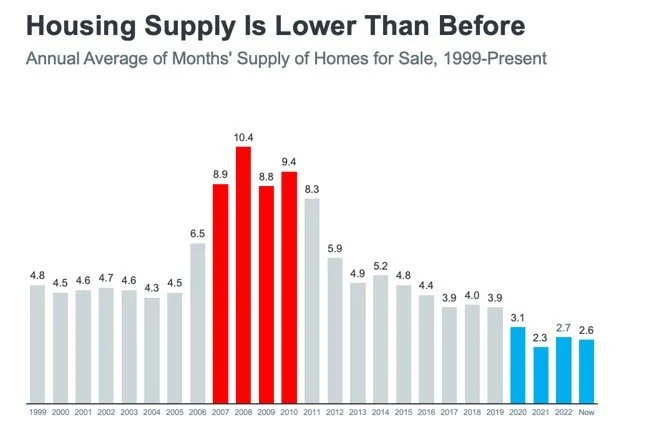

Limited Housing Inventory

During the housing crisis, there was an oversupply of homes for sale, including short sales and foreclosures, resulting in a dramatic decline in prices. Conversely, the present market suffers from a shortage of available inventory, primarily due to years of insufficient home construction.

The graph below, using data from the National Association of Realtors (NAR) and the Federal Reserve, compares the months' supply of homes available today to the period leading up to the crash. Currently, the unsold inventory represents just a 2.6-month supply. With limited inventory, there is insufficient stock to drive home prices down as they did in 2008.

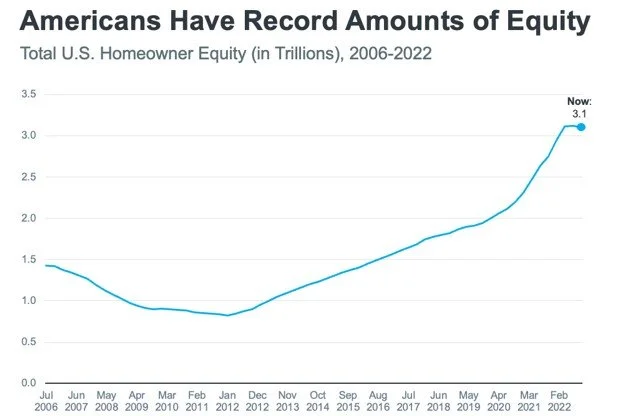

Record-High Equity Levels

The scarcity of homes for sale has exerted upward pressure on home prices throughout the pandemic. Consequently, homeowners now possess near-record levels of equity (see graph below).

This increased equity positions homeowners much more favorably than during the Great Recession. According to Molly Boesel, Principal Economist at CoreLogic:

"Most homeowners are well positioned to weather a shallow recession. More than a decade of home price increases has given homeowners record amounts of equity, which protects them from foreclosure should they fall behind on their mortgage payments."

Bottom Line

The graphs presented should alleviate any concerns regarding an impending housing market crash. The most recent data unequivocally demonstrates that the current market conditions are vastly different from those of the past. Today's housing market is characterized by stability and resilience, providing reassurance to homeowners and investors alike.

Always know, I am here to help you listen and achieve your goals in buying or selling your home. Please feel free to reach out anytime at (801) 885-2558 or email me at brandonrwood19@gmail.com.